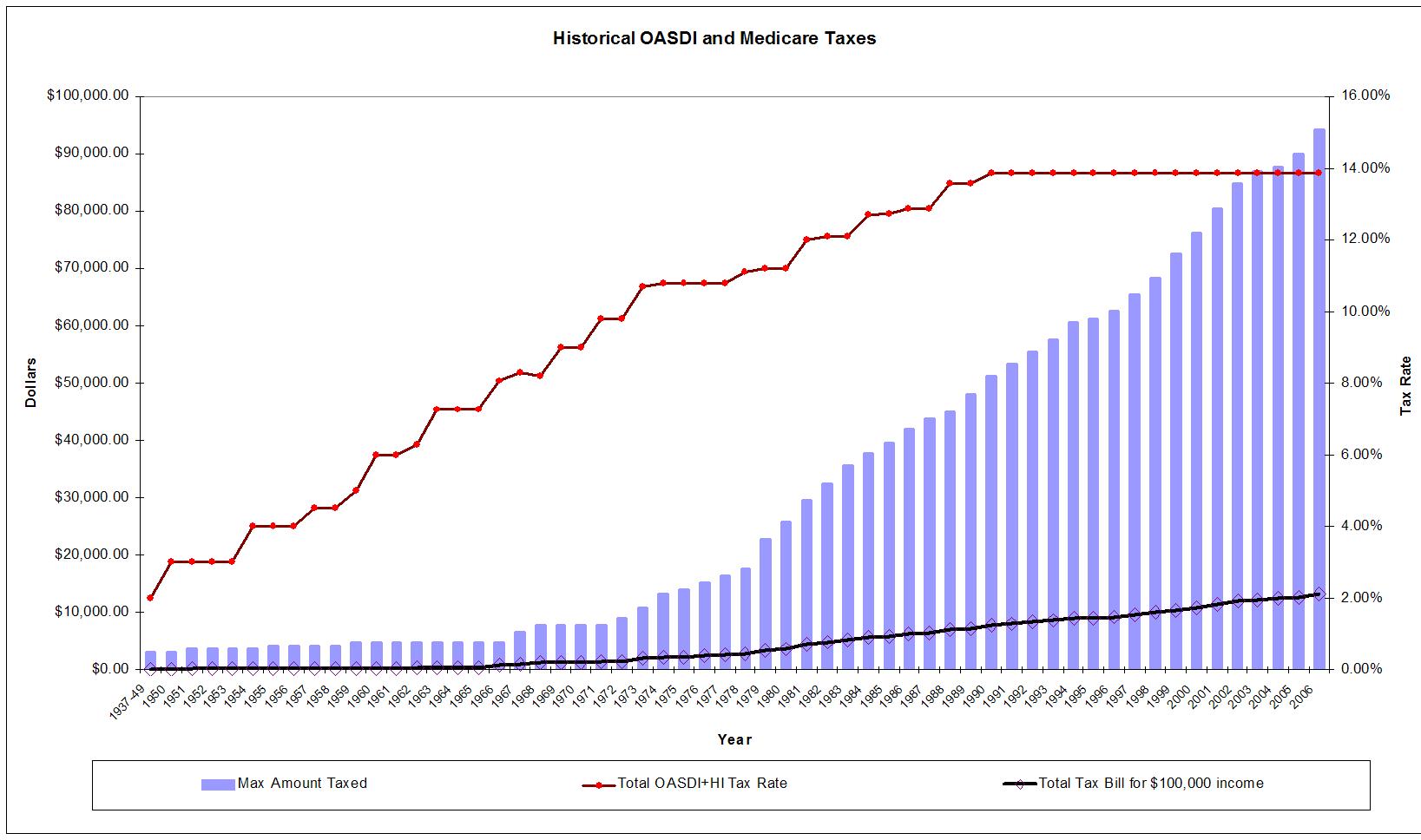

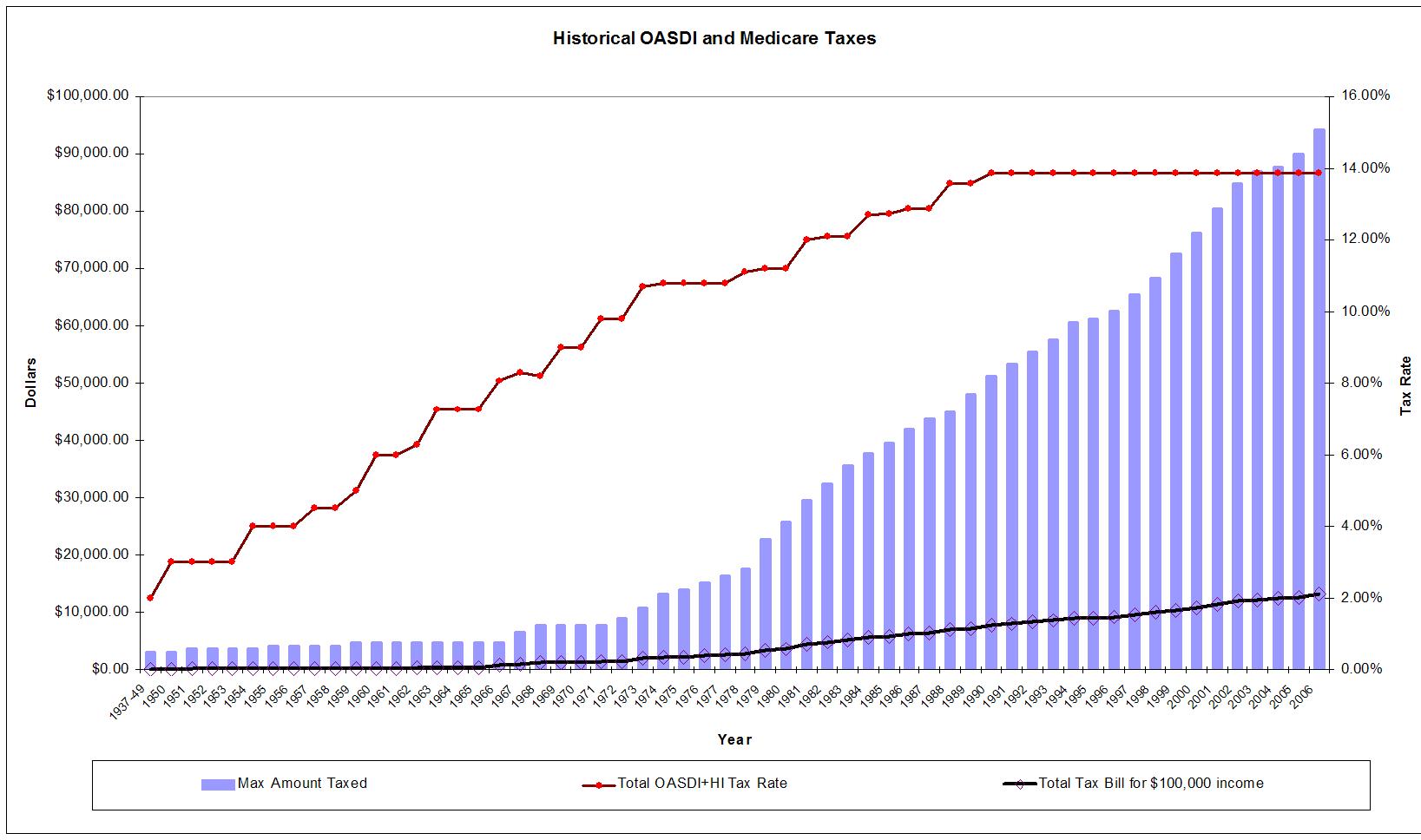

The table below shows the tax rates and maximum amount of income taxed, which is for OASDI taxes only.

The last column shows what the total Social Security tax bill would be for an income of $100,000.

Below is a chart of the key columns.

Back to Social Security Historical Calculator.

| Max Amount Taxed | Employee OASDI Tax Rate | Total OASDI Tax Rate | Hospital Insurance Tax Rate | Total OASDI+HI Tax Rate | Total Tax Bill for $100,000 income |

| $3,000.00 | 1.00% | 2.00% | 2.00% | $60.00 | |

| $3,000.00 | 1.50% | 3.00% | 3.00% | $90.00 | |

| $3,600.00 | 1.50% | 3.00% | 3.00% | $108.00 | |

| $3,600.00 | 1.50% | 3.00% | 3.00% | $108.00 | |

| $3,600.00 | 1.50% | 3.00% | 3.00% | $108.00 | |

| $3,600.00 | 2.00% | 4.00% | 4.00% | $144.00 | |

| $4,200.00 | 2.00% | 4.00% | 4.00% | $168.00 | |

| $4,200.00 | 2.00% | 4.00% | 4.00% | $168.00 | |

| $4,200.00 | 2.25% | 4.50% | 4.50% | $189.00 | |

| $4,200.00 | 2.25% | 4.50% | 4.50% | $189.00 | |

| $4,800.00 | 2.50% | 5.00% | 5.00% | $240.00 | |

| $4,800.00 | 3.00% | 6.00% | 6.00% | $288.00 | |

| $4,800.00 | 3.00% | 6.00% | 6.00% | $288.00 | |

| $4,800.00 | 3.13% | 6.26% | 6.26% | $300.48 | |

| $4,800.00 | 3.63% | 7.26% | 7.26% | $348.48 | |

| $4,800.00 | 3.63% | 7.26% | 7.26% | $348.48 | |

| $4,800.00 | 3.63% | 7.26% | 7.26% | $348.48 | |

| $4,800.00 | 3.85% | 7.70% | 0.35% | 8.05% | $719.60 |

| $6,600.00 | 3.90% | 7.80% | 0.50% | 8.30% | $1,014.80 |

| $7,800.00 | 3.80% | 7.60% | 0.60% | 8.20% | $1,192.80 |

| $7,800.00 | 4.20% | 8.40% | 0.60% | 9.00% | $1,255.20 |

| $7,800.00 | 4.20% | 8.40% | 0.60% | 9.00% | $1,255.20 |

| $7,800.00 | 4.60% | 9.20% | 0.60% | 9.80% | $1,317.60 |

| $9,000.00 | 4.60% | 9.20% | 0.60% | 9.80% | $1,428.00 |

| $10,800.00 | 4.85% | 9.70% | 1.00% | 10.70% | $2,047.60 |

| $13,200.00 | 4.95% | 9.90% | 0.90% | 10.80% | $2,206.80 |

| $14,100.00 | 4.95% | 9.90% | 0.90% | 10.80% | $2,295.90 |

| $15,300.00 | 4.95% | 9.90% | 0.90% | 10.80% | $2,414.70 |

| $16,500.00 | 4.95% | 9.90% | 0.90% | 10.80% | $2,533.50 |

| $17,700.00 | 5.05% | 10.10% | 1.00% | 11.10% | $2,787.70 |

| $22,900.00 | 5.08% | 10.16% | 1.05% | 11.21% | $3,376.64 |

| $25,900.00 | 5.08% | 10.16% | 1.05% | 11.21% | $3,681.44 |

| $29,700.00 | 5.35% | 10.70% | 1.30% | 12.00% | $4,477.90 |

| $32,400.00 | 5.40% | 10.80% | 1.30% | 12.10% | $4,799.20 |

| $35,700.00 | 5.40% | 10.80% | 1.30% | 12.10% | $5,155.60 |

| $37,800.00 | 5.70% | 11.40% | 1.30% | 12.70% | $5,609.20 |

| $39,600.00 | 5.70% | 11.40% | 1.35% | 12.75% | $5,864.40 |

| $42,000.00 | 5.70% | 11.40% | 1.45% | 12.85% | $6,238.00 |

| $43,800.00 | 5.70% | 11.40% | 1.45% | 12.85% | $6,443.20 |

| $45,000.00 | 6.06% | 12.12% | 1.45% | 13.57% | $6,904.00 |

| $48,000.00 | 6.06% | 12.12% | 1.45% | 13.57% | $7,267.60 |

| $51,300.00 | 6.20% | 12.40% | 1.45% | 13.85% | $7,811.20 |

| $53,400.00 | 6.20% | 12.40% | 1.45% | 13.85% | $8,071.60 |

| $55,500.00 | 6.20% | 12.40% | 1.45% | 13.85% | $8,332.00 |

| $57,600.00 | 6.20% | 12.40% | 1.45% | 13.85% | $8,592.40 |

| $60,600.00 | 6.20% | 12.40% | 1.45% | 13.85% | $8,964.40 |

| $61,200.00 | 6.20% | 12.40% | 1.45% | 13.85% | $9,038.80 |

| $62,700.00 | 6.20% | 12.40% | 1.45% | 13.85% | $9,224.80 |

| $65,400.00 | 6.20% | 12.40% | 1.45% | 13.85% | $9,559.60 |

| $68,400.00 | 6.20% | 12.40% | 1.45% | 13.85% | $9,931.60 |

| $72,600.00 | 6.20% | 12.40% | 1.45% | 13.85% | $10,452.40 |

| $76,200.00 | 6.20% | 12.40% | 1.45% | 13.85% | $10,898.80 |

| $80,400.00 | 6.20% | 12.40% | 1.45% | 13.85% | $11,419.60 |

| $84,900.00 | 6.20% | 12.40% | 1.45% | 13.85% | $11,977.60 |

| $87,000.00 | 6.20% | 12.40% | 1.45% | 13.85% | $12,238.00 |

| $87,900.00 | 6.20% | 12.40% | 1.45% | 13.85% | $12,349.60 |

| $90,000.00 | 6.20% | 12.40% | 1.45% | 13.85% | $12,610.00 |

| $94,200.00 | 6.20% | 12.40% | 1.45% | 13.85% | $13,130.80 |

Source: SSA